- Cryptocurrency market trends march 2025

- Cryptocurrency market trends april 2025

- Cryptocurrency market trends february 2025

Best cryptocurrency to buy april 2025

Current analyses indicate Bitcoin nearing its resistance line, suggesting a strong challenge from sellers. The flattening 20-day exponential moving average ($85,152) coupled with a relative strength index (RSI) positioned just above the midpoint hints that bearish momentum is waning https://theshazamcasino.com/. A successful breach above the resistance could propel the BTC/USDT pair to $95,000, potentially even reaching the coveted $100,000 level.

Arthur Hayes, co-founder of BitMEX, has also weighed in, stating that if the Federal Reserve opts for quantitative easing, the Bitcoin price could skyrocket to an astonishing $250,000 by year-end. Such statements indicate the prevailing optimism among analysts, even amidst the volatile conditions typical of cryptocurrency markets.

April 2025 crypto market outlook: Analysis of Fed policy, Trump tariffs, ETH Pectra upgrade, and inflation data. Will Bitcoin’s historical April strength prevail despite limited catalysts? Market projections through June.

Short-term catalyst effect: Historically, major Ethereum upgrades often serve as catalysts for price increases. For example: after the Chaella upgrade in April 2023, ETH rose 45%; before the Dencun upgrade in March 2024, ETH gained 70%. If the Pectra mainnet upgrade goes smoothly, the market may speculate on the technical benefits in advance, driving ETH to continue rising and touching the $2,800-3,000 range.

Cryptocurrency market trends march 2025

We expect this dynamic to shift later in 2024 as a wave of innovative dApps launches, offering new, valuable products that enhance their respective tokens. Key trends include AI-driven applications and decentralized physical infrastructure networks (DePIN), which hold immense potential to capture investor and user interest.

We believe the crypto bull market will persist until 2025, reaching its first peak in the first quarter. At the cycle’s peak, we project Bitcoin (BTC) to be valued at approximately $180,000, and Ethereum (ETH) to trade above $6,000.

President Trump’s policies are making an impact. Nearly a quarter (23%) of non-crypto owners in the US said the launch of a Strategic Bitcoin Reserve increases their confidence in the value of cryptocurrency.

Litecoin is forecasted to trade between $76.50 and $191.10 in 2025. Litecoin’s 50% Fibonacci retracement level at $128.6 will be essential for confirming bullish trends. Stretched target: $250 (low probability).

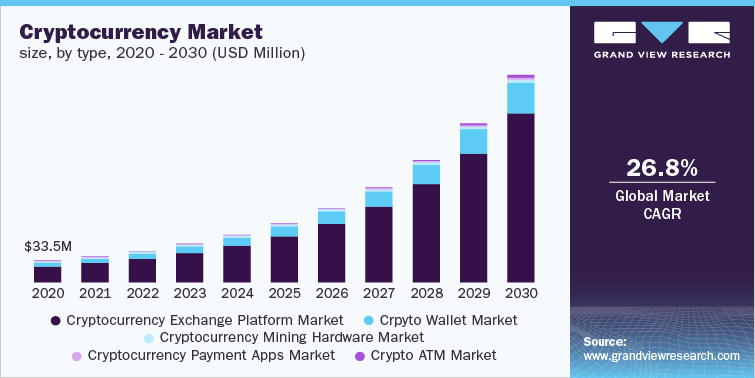

The cryptocurrency market is set for exciting growth in 2025. Experts predict the market will exceed $7 trillion, with Bitcoin potentially reaching $250,000. What else is in store? Let’s take a look at the core trends!

Cryptocurrency market trends april 2025

In an ever-evolving industry, accurate forecasting can prove particularly challenging. However, we can expect certain cryptocurrency market trends to unfold this year, including the intersection of artificial intelligence (AI), selective venture capital funding and stricter regulations of crypto exchanges.

Bitcoin had its prices surge in April 2025, driven by several evolving Crypto Market Trends. Firstly, the approval and launch of Bitcoin spot ETFs by the U.S. Securities and Exchange Commission (SEC) attracted significant institutional investment. These ETFs provided a regulated avenue for investors to gain exposure to Bitcoin without directly purchasing the asset, leading to increased demand and upward price pressure.

April 2025 presents a forward-looking view of the cryptocurrency landscape, marked by both challenges and opportunities. Predictions point towards increased mainstream acceptance, backed by technological innovations and evolving regulations. As blockchain technology becomes a standard for various industries, new forms of collaborations and business models might flourish. The intersection of cryptocurrencies with AI, IoT, and other emerging technologies promises to unleash new possibilities. Lastly, as societal values shift towards sustainability and inclusivity, cryptocurrencies may adapt to integrate these goals. By learning from past experiences, the crypto market aims to solidify its place as a transformative force in global finance.

Blockchain technology’s situation in April 2025 is characterized by rapid innovation. Layer 2 scaling solutions are becoming instrumental in addressing scalability issues, thereby increasing transaction speeds and reducing fees. Interoperability between different blockchain networks is improving, facilitating seamless asset transfers. Privacy features and zero-knowledge proofs are also gaining traction, providing enhanced confidentiality for users. Furthermore, the energy consumption debate surrounding cryptocurrencies, particularly Bitcoin, is seeing advancements in sustainability-focused solutions. Innovations that promote eco-friendly mining practices and reduce carbon footprints are being actively explored, reflecting the evolving consciousness towards environmental sustainability.

In an ever-evolving industry, accurate forecasting can prove particularly challenging. However, we can expect certain cryptocurrency market trends to unfold this year, including the intersection of artificial intelligence (AI), selective venture capital funding and stricter regulations of crypto exchanges.

Bitcoin had its prices surge in April 2025, driven by several evolving Crypto Market Trends. Firstly, the approval and launch of Bitcoin spot ETFs by the U.S. Securities and Exchange Commission (SEC) attracted significant institutional investment. These ETFs provided a regulated avenue for investors to gain exposure to Bitcoin without directly purchasing the asset, leading to increased demand and upward price pressure.

Cryptocurrency market trends february 2025

Total crypto VC capital invested will surpass $150bn with more than a 50% YoY increase. The surge in VC activity will be driven by an increase in allocator appetite for venture activity given the combination of declining interest rates and increased crypto regulatory clarity. Crypto VC fundraising has historically lagged broader crypto market trends, and there will be some amount of “catchup” over the next four quarters. Alex Thorn & Gabe Parker

However, sentiment shifted sharply later in January following DeepSeek’s AI breakthrough, which triggered concerns about overvalued U.S. tech stocks and led to a broader sell-off across traditional and crypto markets, according to Crypto Street.

Beyond trading, the remittance market will explode. For example, stablecoin transfers between the U.S. and Mexico could grow 5x, from $80 million to $400 million monthly, driven by speed, cost savings, and growing trust. Stablecoins will serve as a Trojan horse for blockchain adoption.

Onchain governance will see a resurgence, with applications experimenting with futarchic governance models. Total active voters will increase by at least 20%. Onchain governance has historically faced two problems: 1) lack of participation, and 2) lack of vote diversity with most proposals passing by landslides. Easing regulatory tension, which has been a gating factor to voting onchain, and the recent success of Polymarket suggests these two points are set to improve in 2025, however. In 2025, applications will begin turning away from traditional governance models and towards futarchic ones, improving vote diversity, and regulatory tailwinds adding a boost to governance participation. -Zack Pokorny

Stablecoins will evolve from a niche role in cryptocurrency trading to become a central part of global commerce. By the end of 2025, we project that stablecoins will settle daily transfers of $300 billion, equivalent to 5% of current DTCC volumes, up from $100 billion daily in November 2024. Adoption by major tech companies (like Apple and Google) and payment networks (Visa, Mastercard) will redefine the payments economy.